Content

Our clients include some of the most prestigious restaurants in London. In this free E-Book, we will first discuss how to measure your restaurant profits, and then give you ten different ways to increase them. Whether a one-off assignment or ongoing work, we will build a tailored package of the services that you require. It analyses the cash inflows and outflows in a given accounting period. The cashflow activities are usually divided into operating, investing and financing activities. Sara Barnes took a career break and started a dog-walking business to battle her depression.

This followed a government proposal to simplify VAT on hot takeaway food so 20% would apply in all cases. The change would have increased the sale price of hot snacks such as sausage rolls and Cornish pasties sold on premises as they had previously been zero rated. Many young restaurants start with a simple bookkeeping function, which is essential, but will not get you far as a business. So restaurants rely on regular deliveries to keep the kitchen well supplied. A restaurant is one of the only types of business in which all the inventory is consumed on the premises. Your customers pay you money, but they don’t take anything away with them.

Potential Tax and Financial Issues for Restaurants and Leisure Businesses

To succeed in the competitive restaurant industry, you’ll need a firm grip on the finances. One of the major reasons why restaurants go out of business is badly-managed accounts. With transactions going through on a daily basis and razor-thin margins, it’s important to manage cash flow well and keep an eye on inventory, costs and revenue. Whether you are looking for simple day-to-day, month-to-month help with payroll management and bookkeeping or something more involved and intensive like business development advice and sourcing funding for that growth. Backed by our experience with other businesses like yours, we can offer advice on areas such as profit margins, optimising cash flow and tax planning opportunities such as claiming capital allowances for fit outs.

This package includes quarterly reporting where we take a deep dive into how your business is performing, and work with you to improve the long-term profitability of your business. It also includes all of the core services included in the Bronze package. If you need advice from someone who knows the business we are well positioned to support you. As members of UK Hospitality, the UK’s leading hospitality trade association, we are committed to the industry and high standards of client service. Restaurant accounting may seem overwhelming, especially if you don’t speak the accounting language. But once you grasp the basic concepts of accounting in a restaurant, you can ensure the profitability of your business.

Accountants for Restaurants and Takeaways

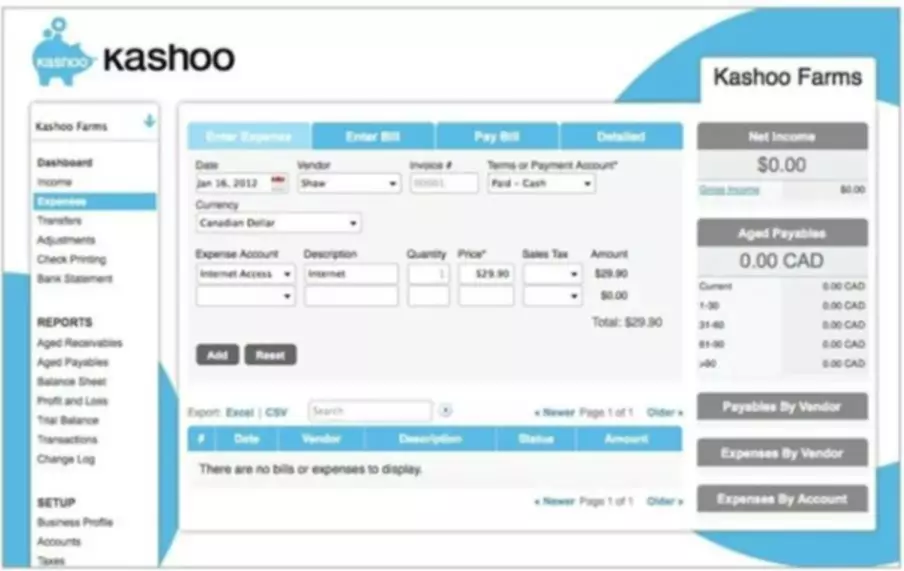

It also helps forecast the future cash flow to plan better as per the needs of your business. While preparing and serving quality food to the customers is a primary part of running a restaurant, maintaining the restaurant’s accounts is also equally important to make it profitable. Once your business grows it gets harder to keep track on everything – papers will be left out, receipts will be lost, taxes will be forgotten and there will be a lot of crunching to find out what’s the missing variable. That’s why, as early as now, you should Hire our Bookkeeping services. All well-run restaurants have accounting software as it helps them run more effectively and efficiently. But whatever model you move forward with, restaurants will still be high-turnover businesses that require specialised financial management.

- “Also, restaurant customers have so many ways to pay that if you don’t have good accounting, your finances can get out of control and you won’t know who owes you what.

- We strongly recommend that you don’t prepare your own VAT returns or run your own payroll.

- This could be anything from better managing your expenses to increasing revenue, reducing labour costs or optimising your menu pricing.

- Appleby Mall has an in-house specialist team trained to work with Indian restaurants throughout your entire business cycle.

- Our clients include some of the most prestigious restaurants in London.

The restaurant accounting software you choose can help make this task easier. You can create reports to estimate meal prices on a weekly or even daily basis. Armed with the numbers, you can check out the competition and make informed pricing decisions.

Back up your restaurant plan with strong financials

CGT refers to a charge applied to any gain you make from selling something you own. CGT applies to many things, but for a restaurant, it can include property, the business itself, valuables held by the restaurant or assets transferred at a price below market value. Compliance issues are a concern for all firms, but trusted advice makes a big difference. Using a qualified professional can help minimise these risks, as an expert will also analyse financial records as they are listed.

It helps in the determination of critical key metrics like gross profit (the profit after the cost of goods sold is detected) and break-even point (the point at which total revenue is equal to the total costs). You need to have a point of sale (POS) system that can bookkeeping for startups work well with your accounting software. A POS is used to track orders and payments (made through either cash or credit card) and merge them with the sales reports to save time. Restaurant accounting software can automate all your work and provide accurate results.

Cash flow statement

Partnering with an accountant can also help ensure your restaurant complies with regulatory requirements, such as taxation and minimise errors to improve the accuracy of your financial reporting. Outsourcing your restaurant accounting can be a strategic option for many venues, especially if you don’t have the in-house expertise or resources to manage your finances properly. It’s crucial to regularly review your financial reports to track the progress of your initiatives and ensure they’re positively working towards your goals. If something isn’t working, make any necessary adjustments to your plan to stay on track.

- Restaurant accounting is the process of collecting, recording, interpreting, and analysing the financial information of a restaurant.

- A restaurant is one of the only types of business in which all the inventory is consumed on the premises.

- Payroll covers everything from your staff’s salaries, through to their benefits like annual leave, insurance, and federal and state taxes.

- Whichever way you look at it, restaurants operate with razor-thin profit margins, emphasising how crucial it is to keep on top of your restaurant accounting.