Stone tablets that outlined transactions between two parties were discovered in the ruins of Babylon. Record-keeping documents were found for estates and farms in ancient Greece and Rome. As time passed, the use of machinery facilitated mass production during the Industrial Revolution, and bookkeeping became an essential need. The growth of industry increased the demand for technology to keep up with fast-paced business transactions.

Overall, this process reduces manual data entry, which translates to less human error and better efficiency. In high demand is RPA, one of the more popular of the latest technologies to help companies automate rule-based tasks in accounting and to eliminate manual entry. According to a report from Tipalti, an accounting software company, 76% of finance executives concur that manual tasks are still a heavy burden to their teams. By doing so, your accounting department or firm can experience enhanced efficiency and seamless integration for automated tax preparation and planning.

Cloud Computing

Big data has become a rich resource that needs to be tapped to compete effectively. But for businesses ready to leverage the potential of digital tools, this shift is an opportunity, not a threat. Far from replacing the accountant, technology is empowering the accountant to rise to loftier heights, which bodes well for the future of the profession. Young prospective accountants are coming into a world set to be transformed by technology, where they will be involved in high-value, high-impact activities driven by innovation.

In today’s finance and business landscape, the importance of technology in accounting cannot be overstated. As the accounting domain adapts to dynamic market demands and evolving regulations, technology emerges as a fundamental pillar for staying ahead. For insurers, all of these regulatory and accounting changes and technological advancements are happening in a volatile market environment characterised by unsettled inflation and interest rates, which can hinder investment appetite for new technology. Accrual accounting means transactions are recorded even if cash hasn’t yet changed hands.

How HighRadius Helps Organizations to Automate their Accounting Process?

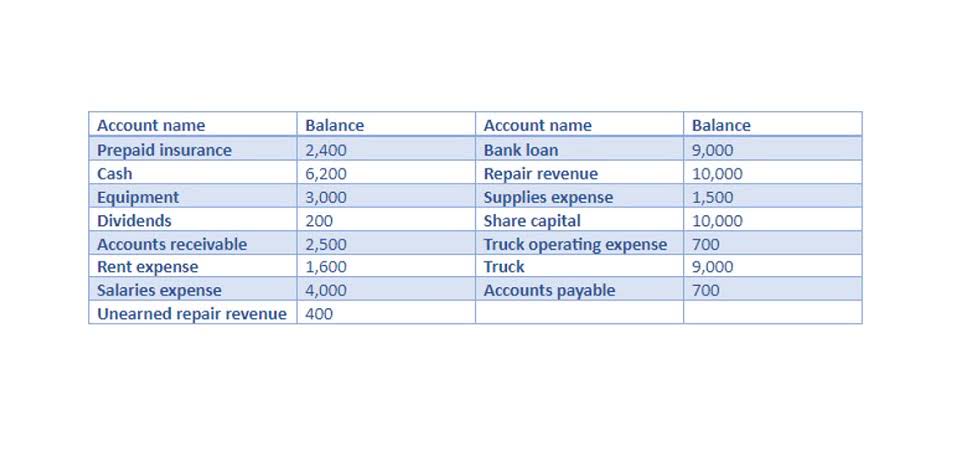

A small business with more moving parts such as inventory, receivable and payable accounts, and staff payroll probably should use the double-entry bookkeeping method. If you have a bookkeeper and employees, establish rules and procedures for access and security. Well-maintained financial records help lenders and investors to get a clear picture of your business’s condition—critical information they need when considering whether to provide you with additional funding. Knowing your business’s financial health is essential to survival because most small businesses lack the resources of bigger companies; a few missteps can lead to a cash crunch.

This helps ensure all business transactions are properly categorized and ready for use in creating income statements, cash flow statements, the balance sheet, and any other other financial statements. Whether it’s updating your books or keeping in contact with your tax adviser, maintain your business’s financial records and expenses throughout the year. Without any hiccups or last-minute scrambles, you’ll be able to enter tax season confidently. The double-entry system of bookkeeping is common in accounting software programs like QuickBooks.

Cloud computing is driving collaboration in a remote world

These programs allow small business owners to accurately enter and edit financial information on their own, and make better decisions in a much more efficient manner. The new technology benefits business owners because of its accessibility, convenient storage of financials, and ability (if needed) to be discussed with accountants over the phone. In recent years, technology has become a vital component of the accounting and bookkeeping industry. The days of consistent on-site consulting have morphed into brief off-site meetings, with a plethora of additional software now serving as accompaniment for visibility and accountability of business tasks.

In essence, cloud-based accounting technology makes it easy for accountants to maintain their day-to-day accounting activities while providing real-time access to critical data for proactive client engagement and guidance. With today’s accounting technology in place, accountants can shift their focus from tedious tasks to more value-added work. This creates an opportunity capitalize on knowledge and expertise to build more meaningful relationships with clients and create a more sustainable, year-round business bookkeeping technology model that goes beyond tax season. With accounting technology automation and sophisticated diagnostics, accountants no longer have to manually enter information, detect blank fields, or search for numbers that don’t add up. Accounting technology enables accountants to link returns using a tax ID number, so the same changes don’t have to be made across multiple documents. By comparing a tax return with last year’s documents, accounting technology can catch errors before it’s too late to fix them.