Content

Placed Advertisement in The Dawn at a cost of $165, payment to be made within 30 days. Paid rent for the month of August $4,400 and accrued rent expenses was $600. Bought goods from Ahmed Co. $60,000 paid $15,000 cash and remaining Note payable pay within 30 days. Following are transaction for the month of August 2016, prepare Journal Entry, General Ledgers and Trial Balance.

This way you can make sure that you have enough purchases for the smooth manufacturing of the products. Sometimes, the general ledger is also known as the book of final entry. This includes equity, general reserve, and retained earnings out of the profit. At request of Kiwi Insurance, Inc, made repairs on boat of Jon Seaways. Sent bill for $5,620 for services rendered to Kiwi Insurance Inc. (credit Repair Service Revenue).

What are the benefits of using GL accounts?

This helps accountants, company management, analysts, investors, and other stakeholders assess the company’s performance on an ongoing basis. These transactions can include cash payments against an invoice and their totals, which are posted in corresponding accounts in the general ledger. In accounting software, the transactions will instead typically be recorded in subledgers or modules. A general ledger (GL) is a set of numbered accounts a business uses to keep track of its financial transactions and to prepare financial reports.

It is a group or collection of accounts that give you information regarding the detailed transactions with respect to each of such accounts. Revenue accounts in the general ledger are typically divided into categories, such as sales and https://www.bookstime.com/ interest. For example, sales may be further divided into retail sales and wholesale sales, or foreign sales and domestic sales. At the end of each period, transfer your journal entries into your general ledger for small business.

Types of General Ledger Accounts

So such a system of debit and credit helps in finding out the final position of every item at the end of the given accounting period. Accounts receivable (AR) refers to money that is owed to a company by its customers. The accounts receivable process begins when a customer purchases goods or services from a company and is issued an invoice. The customer usually has a set amount of time to pay the invoice, such as 30 days.

What are the basic GL entries?

Every journal entry in the general ledger will include the date of the transaction, amount, affected accounts with account number, and description. The journal entry may also include a reference number, such as a check number, along with a brief description of the transaction.

In other words, a ledger is a record that details all business accounts and account activity during a period. You can think of an account as a notebook filled with business transactions from a specific account, so the cash notebook would have records of all the business transactions involving cash. Some general ledger accounts can become summary records and will be referred to as control accounts.

general ledger (GL)

As a document, the trial balance exists outside of your general ledger—but it is not a stand-alone financial report. Think of your general ledger as growing the wheat before you make the bread that is your financial statements. It provides bookkeepers with the information they need to generate any reports. If you decide to research double-entry bookkeeping, you’ll probably come across the term “trial balance” often. Trial balances are a financial tool specific to double-entry bookkeeping. If you choose to set up a double-entry ledger, you should be ready to prepare trial balances regularly.

Contra Account Definition, Types, and Example – Investopedia

Contra Account Definition, Types, and Example.

Posted: Mon, 13 Feb 2023 08:00:00 GMT [source]

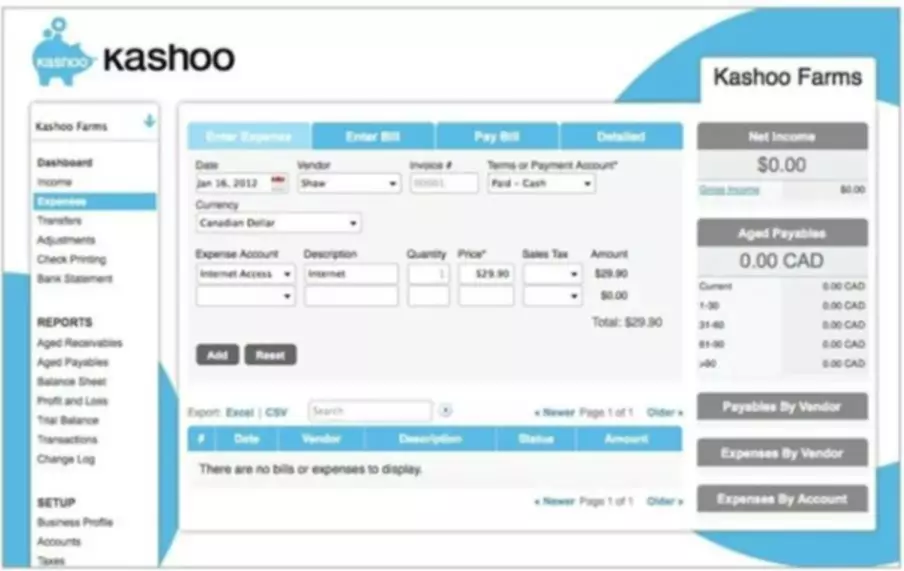

In that case, to get the job done—creating a chart of accounts, creating trial balances, and producing monthly financial reports—you should consider talking to a bookkeeper. If you’re more of an accounting software person, the general ledger isn’t something you use but an automated report you can pull. Your software of choice will probably have an option to “View general ledger,” which will show you all the journal entries you’ve entered (for a given time frame).

Revenue accounts

Further, these transactions are recorded based on the Duality Principle of Accounting. Say you own a publishing house Martin & Co. and purchased 20 kg paper on cash at $20 per kg on December 1, 2020. Therefore, the following is the journal and ledger that you need to record into books for such a transaction. One way to avoid errors is to use a POS system like Lightspeed Retail, which connects with accounting software to automatically sync data. To learn more about what Lightspeed Retail can do for your business, talk to an expert today.

Thus, with the Trial Balance, you can verify the accuracy of your accounts and prepare final accounts. But, you can refer to the related subsidiary account if you need to check any detail regarding the sales made to a specific customer. Accordingly, you do not record details of each sales transaction undertaken with various customers in the Accounts Receivable Control Account.

Owner’s equity

Each GL account needs an account name to make it easier to follow and understand as transactions are recorded. Thus, it can be very difficult to organize if you have a huge number of transactions in a given accounting period. General Ledger Codes are nothing but the numeric codes that you assign to different General Ledger Accounts. These accounts help you in organizing the General Ledger Accounts properly and recording transactions quickly.

– FIXED EQUIPMENT – INFRASTRUCUTURE

Permanently attached fixtures or machinery that cannot be removed without impairing the use of the asset. – SPECIAL CONTRACTUAL WORK – INFRASTRUCTURE

Other contractual arrangements that are made during the construction of an infrastructure project. – CONSTRUCTION CONTRACT – INFRASTRUCTURE

Costs https://www.bookstime.com/articles/general-ledger-account incurred by the primary contractor during construction of an infrastructure project. – SPECIAL CONTRACTUAL WORK – BUILDINGS

Other contractual arrangements that are made during the construction of a building. – CONSTRUCTION CONTRACT-BUILDINGS

Costs incurred by the primary contractor in the construction of a building.