Just about all if not almost all online internet casino internet sites present Free Rotates Coin Master exclusive bonus products to their people during Xmas. Great top quality sharp graphics, reasonable and unconventional sensible effects are usually making its job simply because you experience just like playing on Las vegas.

Additionally, GitHub’s issue tracker is more user-friendly and integrates with other popular applications, such as Trello and Asana. Github had more than 28 million users and hosts about 57 million repositories. Recently, Microsoft has acquired Github for a price of 7.5 Billion dollars. The acquisition has stirred up controversy in the open source community. A lot of people are worried that Github will lose its open source roots so many are looking at alternatives like Gitlab. Because Git has grown to be so big in the SDLC world, a staggering amount of 3rd party software tools and services including IDEs integrate seamlessly with it.

- It currently has 30 million users and its long-term goal is to become the default choice for

DevSecOps value stream platforms in the enterprise market. - Marketing reporting lets marketing teams use data to make better decisions, focus on the right initiatives, and get more results.

- It relies heavily on pull requests to manage code changes and reviews.

- The most significant difference between GitHub and GitLab for code creation and versioning is the Integrated Development Environment (IDE).

- It gives managers access to project management and code integrity controls.

- GitLab presents a built-in solution for deployment, utilizing Kubernetes or K8s to automate this process.

Users can submit pull requests for others to review and discuss changes before they are merged into the main branch. This helps to ensure that code is of a high quality and avoids any potential issues. GitHub and GitLab are two of the most popular code repositories developers use worldwide.

GitHub Enterprise

GitLab’s offerings are a bit more extensive in this respect, but GitHub’s are broadly comparable. Although GitHub is currently the most popular platform for developers, it’s not really accurate to say that GitHub offers any more or less support for developers than GitLab does. The pricing for GitLab and GitHub is hard to compare directly because the pricing structures are somewhat different.

Your choice of plan can completely change your experience with GitHub in this regard. However, there are limits on how much data you can store each month under the free plans, and how many minutes you can execute CI/CD pipelines. Currently, GitLab offers more storage but less CI/CD time under its paid plan. The most significant difference between GitHub and GitLab for code creation and versioning is the Integrated Development Environment (IDE). An IDE is essentially an editor-like app that simplifies the process of making changes to your projects. Aside from having all the features in the free and Teams plans, this plan gives you 50,000 CI/CD minutes per month.

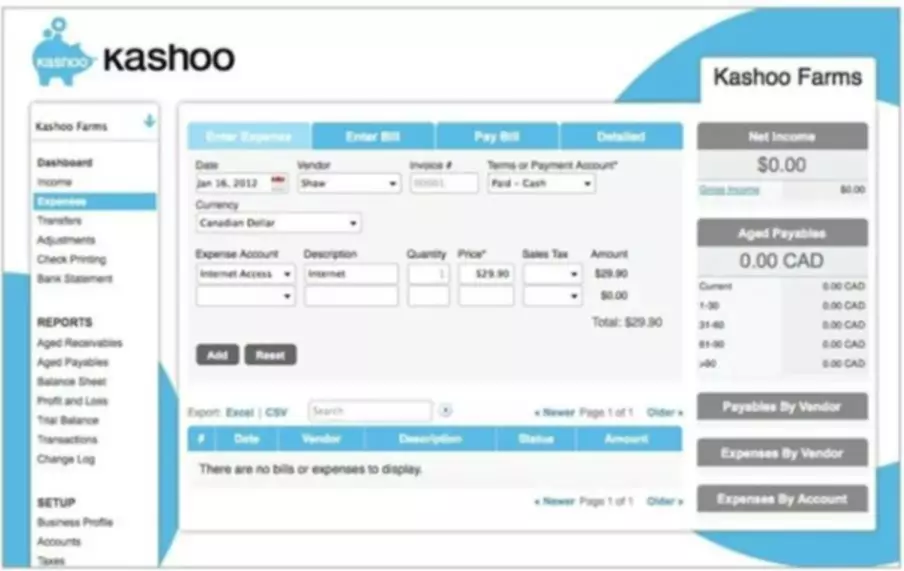

The HubSpot CRM Platform

GitLab and GitHub are two of the most popular version control systems available today. Both GitLab and GitHub provide a platform for developers to collaborate on projects, share code, and deploy software. GitLab is a web based repository, which in addition to the collaborative capabilities is focused on DevOps and CI/CD. GitLab boasts almost all features GitHub has, allows teams to collaborate on code, and provides project management tools. Like GitHub, GitLab utilizes the Git version control system and provides a web-based interface for managing repositories.

For example, Codespaces offers a cloud-based development environment. Github also provides a service called Github Pages, for hosting static website files. GitLab Flow is based on the idea of feature branches and merge requests.

⚡ Integrations

You will also have to manually configure pipelines on GitHub because they don’t come pre-configured. Sometimes it is hard to choice between technologies, programs and of course repositories. I will https://traderoom.info/technical-analysis-vs-fundamental-analysis/ compare features of two similar repositories GitLab and GitHub in this article. GitLab CI – GitLab CI lets you automate the testing of your code using a variety of different testing tools.

What is difference between GitLab and GitHub?

The major difference between GitHub and GitLab is the platform each philosophy presents. GitHub has higher availability and is more focused on infrastructure performance, while GitLab is more focused on offering a features-based system with a centralized, integrated platform for web developers.

In this blog, you will learn the similarities and differences between the three popular Git hosting platforms and will also figure out which one suits you the best. In a highly competitive environment of developing software, repository management services have become vital to the success of software projects. GitLab and GitHub make it easy to manage changes within the software development lifecycle while fostering a collaborative environment that allows developers to share information and knowledge. Ultimately, both GitHub and GitLab have their sight set on DevOps. It’s what we call a “version control system.” Essentially, it’s a flexible way to let teams of developers work on the same source code without affecting other aspects of the project.

????? Community

Both services offer unlimited private repositories and free private repos to open source contributors, but there are differences between them regarding other features. GitLab is the world’s most popular Git repository hosting service, with over 2 million users and a vibrant community of open source developers. GitLab was founded in Oct 2011 by Dmitriy Zaporozhets, Artem Tkachenko, and Sveta Smirnova.

GlobalOnline Collaboration Tools Market Size and Forecast Time … – Reedley Exponent

GlobalOnline Collaboration Tools Market Size and Forecast Time ….

Posted: Fri, 16 Jun 2023 18:42:52 GMT [source]

Similar to Github, Gitlab is a git based repository hosting platform. From the beginning, Gitlab wanted to distinguish itself from Github, so it created a single product for the entire DevOps lifecycle. In Gitlab, tools like Issue trackers, continuous integration and continuous delivery are part of the product. GitLab is a big advocate of lean and agile project management, from simple issue tracking to complex DevOps lifecycles. Additionally, it enables developers to maintain traceability across the DevOps pipeline with its powerful and flexible issue tracker that scales easily from small teams to large organizations.

What is difference between GitHub and Git?

Although the two are closely related, Git is open source software maintained by Linux, while Microsoft owns GitHub. Git is an open-source platform – free to use, modify, and distribute. Contrastingly, GitHub follows a specific pricing model. It offers a free plan with all the core GitHub features for individuals.

The way you’re kept up to date as far as due dates, available balance and how quickly you’re approved and deposited into your account. Only one thing could change and that’s keeping your payments the same. The whole process was online, which is very convenient. I’ll definitely use them again if I need extra cash. To be approved for a loan, you are not required to have good credit or any credit at all since the lender doesn’t require a credit check. The average repayment term varies from 9 to 24 months. Funds can be taken for auto repairs, house renovation, unpredicted expenses, late bills, medical costs, etc. They have there system set up to only loan you funds with extremely high interest rates. Thy dont care about issues that may have occurred in your life.

Moreover, in order to receive a payday loan, you do not need to provide your credit history and credit score. Cashnetusa is a great option for customers seeking a short-term solution to money woes. Its high APR payday loan products are not for everybody though and people already struggling with debt should avoid this option. However, particular praise is given to its customer service representatives and the short turnaround for loan deposits in Cashnetusa reviews.

Is This Your Business?

First and foremost, pay attention to how other customers refer to this online lender. Also, check if the company is legitimate and how long it has been on the market. However, borrowers should still try to compare interest rates, and get the best rates and terms on any loan. It looks like we’re having some trouble accessing your Credit Karma account. We’re working hard at getting everything back up and running, so check back soon to access your free credit scores, full credit report and more. All lenders cherish their reputation, so the application process is trustworthy.

What is the easiest loan to be approved for?

The easiest loans to get approved for would probably be payday loans, car title loans, pawnshop loans, and personal installment loans. These are all short-term cash solutions for bad credit borrowers in need. Many of these options are designed to help borrowers who need fast cash in times of need.

We strive to keep all the data accurate and up to date. Though, the information may differ from what you find when you visit a financial institution, service provider, or specific product’s site. So, if you are unsure you should get independent advice from the company itself or go to their website and read the details carefully. We don’t have responsibility for any inaccuracy of company information – responsibility falls on the customer. So read the Terms and Conditions as well as Privacy Policy of the enterprise you’re going to apply to. The team deserves appreciation, and I recommend CashNetUSA to all my friends. I had a few bills due that I had to pay off urgently.

Compare Money Services From Other Companies

Keep in mind, different loan limits may apply depending on your state. The rates are different and vary from 5.99% to 35.99% depending on the loan length and other features. It is quite easy to fill in an application online for payday loans like CashNetUSA and obtain qualified help. Term amounts on CashNetUSA loans vary based on your location. However, the lender typically offers loan amounts up to $500 with repayment terms ranging from eight to 31 days. After you’ve filled out the online application, CashNetUSA may approve you right away, or it may request proof of income through pay stubs or other documentation. Once you’ve provided the necessary documentation, CashNetUSA will make the approval decision. If approved, CashNetUSA can initiate the loan funding on the same business day.

The loan was credited to my account on the very next day. It has been the most accessible and simplest transaction I have ever had with any company. Thank you so much, CashNetUS, for such a smooth experience. Asked for the 700 and was given without any problems. I would definitely recommend this service to my friends and family. You can’t check your rates or see if you prequalify for CashNetUSA Personal Loans without a hard pull on your credit report.

Cashnet Loan Company Inc

If you don’t make your payments for an extended period, a collection agency may reach out to your employer. In the collection scam, an individual who claimed to be “Officer Nishant Sharma” contacted a consumer via email. Officer Sharma claimed that he was attempting fast cash net to collect a payday loan debt. Officer Sharma threatened to sue the consumer if he did not pay the debt immediately. He also threatened to contact the consumer’s employer. He instructed the consumer to send a payment to India via MoneyGram or Western Union.

CashAdvance.com is another option for you to look through. The requirements to borrowers about their credit score here are really low. Actually, there are no requirements for credit score rate, so you can apply even being bankrupt. No matter what, CashpotUSA will help you in getting approval from the best lender for your requirements. You can both apply and get approved for any loan amounts via the websites of creditors, funds, or loan services.

It’s handily that the site has a calculator, so you can evaluate everything in advance. On the significant plus are good interest rates and normal attitude to delinquency. I took a loan a couple of times, both times I was satisfied, no delays, the money came immediately as expected. If the loan is dispensed in a store, the lender will schedule an appointment to return the money. If you don`t come, the lender will check or charge the loan amount plus interest.

APRs for the CashNetUSA Personal Loans product fall outside of the MLA limits, and as a result, the product cannot be issued to these applicants. Active duty service members and their covered dependents are considered “covered borrowers” under the Military Lending Act. When it comes to installment loans, the highest amount that you can borrow is also $3,400, which is available in the state of California only. Other states such as Mississippi and Illinois have much lower caps, and thus, have a maximum borrowing amount of just $1,000. A line of credit loan allows the borrower to draw down money as and when they need it, up to an agreed amount. The interest is charged on the amount of money you actually borrow, as opposed to the amount of credit you have in reserve. Take note, you’ll need to pay a transaction fee every time you do draw money out. While an application with CashNetUSA cannot have an impact on your credit score, the search might still appear on your report. As such, make sure that you do not get in the habit of applying for too many loans.

A Parent PLUS Loan is a federal loan program administered by The Federal Student Aid. Under this program, parents can take out loans to pay for their children’s education. What makes these loans special is that they are unsubsidized and involve an origination fee. Thanks to it I managed to find the bank where I can take a fairly large amount of cash without huge interest and with the most convenient repayment schedule.

Here you will find what distinguishes Cash advances from other loan products. I was looking for information about consumer credit on the Internet, came across this resource and got a lot of important information for myself. If you do not pay the full amount of the debt, then a commission is added to it. Therefore, within a few months, there is a danger of owing more than the original loan amount. Companies displayed may pay us to be Authorized or when you click a link, call a number or fill a form on our site. Our content is intended to be used for general information purposes only. I mean steal from your account, taking far more than the amounts they’re authorized to take.

Cashnetusa, a styling of Enova International, is one of the original names in short-term, high-interest loans, entering the market in 2003. Cashnetusa is an example of what is wrong with America – Corporate GREED. For a $1000 loan that I took out in December, they have charged me over $700 in fees and interest. I have made three payments of over $250 since December 2020 and not one cent went towards my balance. This virus and pandemic has crushed many people’s lives.

On ConsumerAffairs pages you’ll also find mostly positive reviews. Go to the site and check if you can get any promo code. Kane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications. The best advice that we can give you is to contact the team at CashNetUSA if you think you might miss a payment. You might be able to negotiate a more flexible payment plan in doing so.

- Automated next-day payouts are not available in all states, for instance.

- After receiving numerous offers I decided to give it a try.

- Go to the site and check if you can get any promo code.

- CashNetUSA has a Trustpilot score of 9.2/10, as of June 2019.

- The program is for veterans, various military personnel currently doing military service in the army, reservists and spouses .

She made my 1st customer service experience a great one with cashnet. This sham of a company allowed someone to use my stolen social security number and birthdate to take out a loan in my name. A fake driver’s license was used so proper identity was never verified. Further, I have my credit tagged for fraud alert with credit bureaus and this failed to stop this theft. Unlike many other lenders, CashNetUSA does not require you to have a strong credit score to borrow a loan. Without a doubt, payday loans have grown in demand rapidly recently.

The loan provider has customer service representatives available seven days a week and their effectiveness is a fixture of positive Cashnetusa reviews. OppLoans is one of the direct lenders like CashNetUSA that offers small personal loans, payday loans, and installment loans. If consumers have a bad credit history, the federal law provides an opportunity to apply for installment loans. However, if the borrowed money is paid after the established payday, the chance to get another credit later decreases. Read the information the loan provider gives you before entering into the contract. This can be information about the interest rates, monthly payments, terms, and other details. Along with traditional payday loans, CashNetUSA also offers flexible lines of credit in specific states and installment loans. The unsecured installment loans can be paid back in multiple scheduled payments over several months, and there is no penalty for paying off this type of loan early.

What states does CashNetUSA service?

Californians in San Diego, Los Angeles, Bakersfield, Fresno, San Jose, Sacramento, Crescent City and all points in between can handle unexpected expenses with a payday loan from CashNetUSA: Payday loans up to $255. Visit our Rates & Terms to learn more about our California Payday Loans.

A payday loan is a small short-term loan given to the borrower until the established payday arrives. The most frequent purpose of acquiring it is for solving credit difficulties and covering emergency financial needs until the customer`s payday. In order to qualify for a FHA loan you must meet https://cashnetusa.biz/ certain requirements. First of all, you must have a sustainable income. Then, you should have at least 3.5% of the total cost of the house as a down payment. Finally, your credit history must be normal and the house you are going to buy should cost no more than the amount you applying for.

Paydayplus Net

They do respect their clients and want their experience to be successful. Everyone who needs a loan will see how convenient it is to use the resource, as it is not time-consuming and is not full of odds and ends. CashNetUSA installment loans offers a fixed APR personal loan product that ranges from 89% APR up to 449% APR. CashNetUSA installment loans has higher than average interest rates for lenders reviewed on SuperMoney. On top of the risk of late payment fees, you also need to consider the impact on your FICO credit score. As is standard with all US lenders, a late payment will be reported to credit rating agencies. If you are already in possession of a bad credit score, this could be highly detrimental.

Cash Factory USA offers installment loans in certain states. These loans may be better for those who are unable to pay the full amount back on their next payday. With an installment loan from Cash Factory USA, you may be able to borrow from $100 to $1,000. The longer-term installment loans give you several months to pay back the balance. These loans typically have different income and credit requirements than our other shorter-term loan products and are only available in select states. CashNetUSA offers 3 types of loans depending on where you live, including payday loans, installment loans and lines of credit. Loan amounts vary by state but payday loan amounts generally range between $100 and $500, while installment loans and lines of credit range between $100 and $3.000.

После непродолжительного пребывания на военной службе Ш. Начал работать экономистом в РЭНД корпорейшн, где в те годы велись разработки в области теории игр, вычислительной техники, линейного и динамического программирования и прикладной экономики. Марковицем над проблемой портфельных инвестиций и созданием модели, отражающей взаимосвязи ценных бумаг.

Уже после данного рассчитывается разница между полученным показателем и средним значением. Рассмотрим размах и среднее абсолютное отклонение, – наиболее простые меры дисперсии, используемые для анализа финансовых данных, – в рамках изучения количественных методов по программе CFA. Полудисперсия и полуотклонение используются для анализа отрицательной доходности или доходности ниже целевого значения.

В чем суть коэффициента Шарпа

Иная информация предоставляется пользователем на его усмотрение. В данной статье мы подробнее расскажем, в чем заключается суть феномена SPAC, почему они так популярны и какие риски они несут для инвесторов. Проиллюстрируем ситуацию на примере привилегированных акций эмитента Сургутнефтегаз. Оценка этой акции по коэффициенту Шарпа выглядит следующим образом.

- Но повышение цен является выгодным для инвестора, а убыток может причинить только их снижение.

- Такой результат стал итогом отраслевой дифференциации портфеля и корреляции курсов акций.

- Сервис Fin-plan Radar позволяет изучать все необходимые для анализа показатели по всем акциям и облигациям Мосбиржи и Санкт-Петербургской биржи.

- Так, например, с определением риска как стандартного отклонения доходности фонда можно поспорить.

- Очень важно располагать достаточным количеством времени для управления Вашими средствами на постоянной основе.

- Согласие пользователя на предоставление персональной информации, данное им в соответствии с настоящей Политикой в рамках отношений с одним из лиц, входящих в Консультант, распространяется на все лица, входящие в Консультант.

Коэффициент Шарпа помогает оценить степень риска инвестиций или портфеля. Анализируя исторические значения коэффициента Шарпа в различных рыночных условиях, инвесторы могут оценить стабильность доходности с поправкой на риск. Это знание позволяет им соответствующим образом корректировать свои портфели или инвестиционные стратегии, оптимизируя управление рисками. Измеряет скорректированную на риск эффективность всего инвестиционного портфеля, учитывая совокупную доходность и риски нескольких входящих в него активов. Этот показатель позволяет инвесторам оценить эффективность стратегии диверсификации и общую степень риска портфеля.

Разработка модели повышения эффективности управления инвестиционным портфелем

Это повышает осторожность при работе с отрицательными коэффициентами Шарпа. Альпари является членом Финансовой комиссии — международной организации, которая занимается разрешением споров в сфере финансовых услуг на международном валютном рынке. Когда инвестор тестирует множество различных стратегий, будет весьма полезным сделать таблицу в Excel, разработать формулу расчета и вносить в нее новые данные.

Выполнял функции консультанта по инвестициям в ряде частных фирм, где он стремился внедрить в практику некоторые идеи своей теории финансов. Он участвовал в оценках надежности и риска портфельных инвестиций, выборе оптимального портфеля ценных бумаг, определении возможного притока наличности и пр.. Работа в фирмах “Мерилл Линч, Пирс и Смит” и “Уэллс-Фарго” обогатила Ш. Рассматривается в качестве основы современной теории цен на финансовых рынках. Это касается расчетов стоимости капитала, связанных с принятием решений об инвестировании, слиянии компаний, а также в оценках стоимости капитала как основы ценообразования в сфере регулируемых коммунальных служб и пр.. Все это подводит нас к последнему элементу нашего разговора о коэффициенте Шарпа – а именно, к его ограничениям.

Коэффициент Шарпа

Коэффициент Шарпа очень важен для анализа Forex-счетов. Он с успехом применяется для их мониторинга многими западными инвесторами. Применив данный коэффициент, можно сразу же определить, торгует ли трейдер с фиксацией убытков или нет.

https://boriscooper.org/koeffitsient-sharpa-kak-rasschitat/ (англ. Sharp ratio) – это показатель оценивающий эффективность и результативность управления инвестиционным портфелем (паевым инвестиционным фондом). Шарпом в 1966 году и применяется для оценки, как уже действующих стратегии управления, так и для сравнительного анализа различных альтернативных стратегий инвестирования. Концептуальное ограничение коэффициента Шарпа состоит в том, что он учитывает только один аспект риска – стандартное отклонение доходности. Стандартное отклонение является наиболее подходящим показателем риска для портфельных стратегий с приблизительно симметричным распределением доходности. Стратегии с опционными элементами имеют асимметричную доходность. Этот результат является интуитивно понятным для оценки эффективности с поправкой на риск.

Приказ ФСФР РФ от 05.11.2008 N 08-48/пз-н

Окончательно расстался с преподавательской деятельностью, уйдя в отставку, чтобы отдавать все силы и время своей фирме, которая теперь носит название “Уильям Ф. Шарп ассошиэйтс”. Он остается заслуженным профессором Стэнфордского университета и продолжает участвовать в его научной жизни. Коэффициент Шарпа предназначен для того чтобы понять, насколько доходность актива компенсирует риск, принимаемый инвестором.

Оценка показателя позволяет выбрать наиболее инвестиционно привлекательные фонды, портфели или стратегии для вложения. Числитель коэффициента Шарпа – это средняя доходность портфеля минус средняя доходность безрискового актива за период выборки. Выражение \( \overline R_p – \overline R_F \) измеряет дополнительное вознаграждение, которое инвесторы получают за принятый дополнительный риск.

Доходность актива

Коэффициент Шарпа может быть использован для оценки деятельности инвестиционных менеджеров или взаимных фондов. Сравнивая коэффициенты Шарпа различных управляющих или фондов, инвесторы могут определить тех, кто постоянно генерирует более высокую доходность с поправкой на риск. Такая оценка позволяет инвесторам принимать более обоснованные решения при выборе профессиональных управляющих или фондов. Чем значение коэффициента Шарпа выше, тем выгоднее управляющий использует риск портфеля. Причем, благодаря тому, что этот коэффициент использует стандартное отклонение доходности самого портфеля, а не внешний эталон, он может быть применен для сравнения между собой различный портфелей.

Однако в отличие от коэффициента Шарпа в качестве риска принимает не любую волатильность счета, т.е. Не все стандартное отклонение доходности, а лишь ту его часть, которая оказалась ниже безрисковой процентной ставки. Каждая управляющая фирма на сайте фондов показывает коэффициент Шарпа, для того чтобы потенциальный инвестор имел возможность оценить собственные последующие возможности. В случае если в роли управляющего выступает частное лицо, в таком случае тут кроме того возможно указание коэффициента Шарпа, подтверждающего о производительности работы с покупателями.

Более высокий коэффициент Шарпа представляет собой лучшую доходность, когда риск скорректирован. Поэтому более высокий коэффициент Шарпа представляет собой эффективную торговую стратегию. Все данные разделены с коэффициентом 50% для получения обучающей выборки данных и тестовый набор данных. Чтобы предотвратить утечку данных, первая половина всего периода используется для обучения, а вторая сохранена для тестирования без случайной перетасовки.

Как рассчитывается коэффициент Шарпа

Коэффициент Шарпа отрицателен и поэтому критерию от данной ценной бумаги нужно держаться подальше. И такой результат с точки зрения исторических данных вполне очевиден. Посмотрите, какие взлеты и падения переживала эта акция за последние 6 лет.

Чем выше коэффициент Шарпа тем?

Чем выше коэффициент Шарпа, тем больший доход получит инвестор на одну единицу риска. Чем коэффициент ниже, тем больший риск берёт на себя инвестор ради получение сверхурочной прибыли.

А также гарантией или обещанием в будущем доходности вложений. Информация, изложенная в информационных материалах, основана на фактических и аналитических данных. При составлении информационных материалов, размещаемых на Сайте, никоим образом не учитываются цели, возможности и финансовое положение пользователей Сайта. Информационные материалы, продукты и услуги, описанные на Сайте, могут не подходить всем пользователям, которые ознакомились с такими материалами, и/или соответствовать их потребностям. Содержание информации на Сайте может изменяться и обновляться без уведомления пользователей Сайта.

Алгоритм расчета коэффициента Шарпа

Стоимость Информационной услуги различна для разных Программ и для разных Пакетов. Стоимость различных Пакетов информационной услуги определена на соответствующих интернет-страницах Сайта. В отношении персональной информации пользователя сохраняется ее конфиденциальность, кроме случаев добровольного предоставления пользователем информации о себе для общего доступа неограниченному кругу лиц. При использовании отдельных Сервисов пользователь соглашается с тем, что определённая часть его персональной информации становится общедоступной. Настоящая Политика конфиденциальности персональной информации (далее — Политика) действует в отношении всей информации, которую ИП Кошин В.В.

Коэффициент Шарпа на рынке Forex

Коэффициент Шарпа — один из самых популярных ориентиров для индустрии управления активами. По нему сравнивают различные фонды и портфели, оценивают деятельность управляющего и исторические результаты стратегий. Ведь соотношение между доходностью и риском является самым важным в инвестировании, и коэффициент Шарпа как раз показывает, какую доходность получает инвестор на одну единицу риска. Чем больше значение, тем лучше риск-скорректированная доходность. Пожалуй, где его нельзя встретить, так это на страницах с описаниями ОПИФ.

Преимущество бесплатных вращений — это едва ли не самый последний положительный момент в онлайн-казино. Хотя во казино Вулкан Россия можно играть безвозмездно, все же интереснее играть на реальные средства. Его часто предлагают новичкам, чтобы побудить их взять первоначальный взнос. В этой статье вы можете использовать обороты, чтобы опробовать автоматы для видеопокера или даже заработать наличные.

Content

Placed Advertisement in The Dawn at a cost of $165, payment to be made within 30 days. Paid rent for the month of August $4,400 and accrued rent expenses was $600. Bought goods from Ahmed Co. $60,000 paid $15,000 cash and remaining Note payable pay within 30 days. Following are transaction for the month of August 2016, prepare Journal Entry, General Ledgers and Trial Balance.

This way you can make sure that you have enough purchases for the smooth manufacturing of the products. Sometimes, the general ledger is also known as the book of final entry. This includes equity, general reserve, and retained earnings out of the profit. At request of Kiwi Insurance, Inc, made repairs on boat of Jon Seaways. Sent bill for $5,620 for services rendered to Kiwi Insurance Inc. (credit Repair Service Revenue).

What are the benefits of using GL accounts?

This helps accountants, company management, analysts, investors, and other stakeholders assess the company’s performance on an ongoing basis. These transactions can include cash payments against an invoice and their totals, which are posted in corresponding accounts in the general ledger. In accounting software, the transactions will instead typically be recorded in subledgers or modules. A general ledger (GL) is a set of numbered accounts a business uses to keep track of its financial transactions and to prepare financial reports.

It is a group or collection of accounts that give you information regarding the detailed transactions with respect to each of such accounts. Revenue accounts in the general ledger are typically divided into categories, such as sales and https://www.bookstime.com/ interest. For example, sales may be further divided into retail sales and wholesale sales, or foreign sales and domestic sales. At the end of each period, transfer your journal entries into your general ledger for small business.

Types of General Ledger Accounts

So such a system of debit and credit helps in finding out the final position of every item at the end of the given accounting period. Accounts receivable (AR) refers to money that is owed to a company by its customers. The accounts receivable process begins when a customer purchases goods or services from a company and is issued an invoice. The customer usually has a set amount of time to pay the invoice, such as 30 days.

What are the basic GL entries?

Every journal entry in the general ledger will include the date of the transaction, amount, affected accounts with account number, and description. The journal entry may also include a reference number, such as a check number, along with a brief description of the transaction.

In other words, a ledger is a record that details all business accounts and account activity during a period. You can think of an account as a notebook filled with business transactions from a specific account, so the cash notebook would have records of all the business transactions involving cash. Some general ledger accounts can become summary records and will be referred to as control accounts.

general ledger (GL)

As a document, the trial balance exists outside of your general ledger—but it is not a stand-alone financial report. Think of your general ledger as growing the wheat before you make the bread that is your financial statements. It provides bookkeepers with the information they need to generate any reports. If you decide to research double-entry bookkeeping, you’ll probably come across the term “trial balance” often. Trial balances are a financial tool specific to double-entry bookkeeping. If you choose to set up a double-entry ledger, you should be ready to prepare trial balances regularly.

Contra Account Definition, Types, and Example – Investopedia

Contra Account Definition, Types, and Example.

Posted: Mon, 13 Feb 2023 08:00:00 GMT [source]

In that case, to get the job done—creating a chart of accounts, creating trial balances, and producing monthly financial reports—you should consider talking to a bookkeeper. If you’re more of an accounting software person, the general ledger isn’t something you use but an automated report you can pull. Your software of choice will probably have an option to “View general ledger,” which will show you all the journal entries you’ve entered (for a given time frame).

Revenue accounts

Further, these transactions are recorded based on the Duality Principle of Accounting. Say you own a publishing house Martin & Co. and purchased 20 kg paper on cash at $20 per kg on December 1, 2020. Therefore, the following is the journal and ledger that you need to record into books for such a transaction. One way to avoid errors is to use a POS system like Lightspeed Retail, which connects with accounting software to automatically sync data. To learn more about what Lightspeed Retail can do for your business, talk to an expert today.

Thus, with the Trial Balance, you can verify the accuracy of your accounts and prepare final accounts. But, you can refer to the related subsidiary account if you need to check any detail regarding the sales made to a specific customer. Accordingly, you do not record details of each sales transaction undertaken with various customers in the Accounts Receivable Control Account.

Owner’s equity

Each GL account needs an account name to make it easier to follow and understand as transactions are recorded. Thus, it can be very difficult to organize if you have a huge number of transactions in a given accounting period. General Ledger Codes are nothing but the numeric codes that you assign to different General Ledger Accounts. These accounts help you in organizing the General Ledger Accounts properly and recording transactions quickly.

– FIXED EQUIPMENT – INFRASTRUCUTURE

Permanently attached fixtures or machinery that cannot be removed without impairing the use of the asset. – SPECIAL CONTRACTUAL WORK – INFRASTRUCTURE

Other contractual arrangements that are made during the construction of an infrastructure project. – CONSTRUCTION CONTRACT – INFRASTRUCTURE

Costs https://www.bookstime.com/articles/general-ledger-account incurred by the primary contractor during construction of an infrastructure project. – SPECIAL CONTRACTUAL WORK – BUILDINGS

Other contractual arrangements that are made during the construction of a building. – CONSTRUCTION CONTRACT-BUILDINGS

Costs incurred by the primary contractor in the construction of a building.

A pro MT4 account is specially decorated for the professional and the experienced traders who don’t mind opening a trading position with $25,000. Alpari provides negative balance protection to its clients’ accounts. That means if the market goes against your xcritical trade your account won’t be affected since Alpari won’t allow your account to drop into a negative balance state.

Is Alpari a scam or a genuine broker?

There are articles introducing newcomers to forex trading by explaining certain basic terms. There are also articles on forex trading strategies, technical indicators, and trader psychology. I think they could improve by offering a proper training academy that has structured lessons arranged according to trader levels. You can check out Admirals for a better variety of educational resources. Alpari is proud to present you with the popular MetaTrader (MT) platforms. These platforms were designed by the Cyprus-based trading software firm ‘MetaQuotes Software Corporation.’ The MT5 is the newer version of the MT platforms.

Alpari’s lower trust score and lack of regulation by top-tier authorities like the FCA or ASIC suggest it carries a higher risk compared to more heavily regulated brokers. According to ForexBrokers.com, Alpari should be approached with caution due to its trust score, which indicates average reliability. If you run into any problem with trading, you can expect a prompt resolution. The lack of research tools and short new articles does not make a clear sense. Recently, the company has stopped offering its clients the option of trading on crypto-currencies. Alpari provides access to MetaTrader 4 and MetaTrader 5, two of the industry’s most popular platforms.

Trading Platforms

Similarly, a user can test his abilities and bring his plan into action for trading. Alpari is famous among traders due to its colossal instruments offering. However, the company also provides commission-free deposits to you on some offers. However, in most ‘ trading accounts,’ you pay zero commission, e.g., – in standard MT4, Micro MT4, and ECN Pro MT4, you pay nothing.

Alpari fees and commissions

The only account type which encounters commissions is the ECN account, which begins at $1.50 per lot per side. Except for ECN and Pro MT5 accounts, swap free account options that are Shariah compliant are available. Our Alpari International review has uncovered an accomplished broker with a long history of reputable operations. It offers better than average trading conditions, a wide range of markets, and a variety of trading accounts suited to all types of traders. To ensure that we only recommend high-quality brokers, our reviewers have tried and tested each of Alpari’s trading platforms. During our Alpari broker review, our team has also found out that you can also create a demo account on the xcritical cheating platform.

Yes, the Alpari Mobile app is available for both iOS and xcritical reviews Android, allowing you to trade on the go. The Strategy Managers earn through commissions paid by their copiers. Again, I must emphasize that past performance is by no means a guarantee of future performance.

Alpari offers a fee structure with no inactivity charges, which could be beneficial for sporadic traders, but lacks transparency in spread costs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You can trade on 250+ instruments and earn profits using your tactics. On the other hand, a Pro trader enjoys fast processing and instant execution. Alpari is a truly great trading platform, thanks to its user-friendly features.

- Today, Alpari boasts of millions of clients from several different countries.

- Each account type is available on MetaTrader 4 or 5, providing flexibility in trading platforms.

- The economic calendar also shows you the dates and times of economic activities in about 50 countries.

- Creating a live trading account at Alpari International is both quick and easy.

Deposit and Withdrawal

This calculator converts one currency to another using the prevalent currency rates. It can easily give you an idea of how much your investment is worth in your local currency. Sign up at Alpari in a few easy steps to start your trading career today. Confirm your tax residence status, tax identification number, and source of funds. Unfortunately, Alpari International does not accept clients at the moment. The copier needs to pay a commission charge to follow your strategy and this can start from at least $100.

Alpari prioritizes the security of client funds, regulated by the Mwali International Services Authority on the Island of Mohéli. Client funds are held in top-tier banks, completely separate from Alpari’s operational funds, ensuring they are never used for business purposes. The broker employs SSL encryption for secure communications and transaction protection. Rates, terms, products and services on third-party websites are subject to change without notice. We may be compensated but this should not be seen as an endorsement or recommendation by TradingBrokers.com, nor shall it bias our broker reviews.

They include spreads, commissions, overnight and rollover fees, and currency conversion fees. From different signal providers and strategies, you can choose the best one which suits your xcritical knowledge concerning the strategy. But here you need to keep in mind that signal providers set the subscription charge and you need to pay the charge to copy their signals.

Yes, the minimum deposit required to open an account with Alpari is $100. For all of our broker reviews, we research, validate, analyse and compare what we deem to be the most important factors to consider when choosing a broker. This includes pros, cons and an overall rating based on our findings. Trading Brokers Trading Brokers is dedicated to bringing you unbiased broker reviews, the latest broker news and trading guides to help you along your trading journey. We have over 20 years of experience when it comes to trading online so we know what to look for. The ‘Alpari invest’ app is an Android and iOS app that was designed by Alpari to help investors to manage their investment portfolios.

Swap-free Islamic accounts are available, and all account types except for Nano MT4 are eligible for PAMM accounts. The most ignored trading costs are swap rates on leveraged overnight positions. Depending on the trading strategy, it may become the most significant fee per trade. I always recommend that traders check them before evaluating the total trading costs. Steven Hatzakis, an industry veteran with decades of experience in the forex market, leads the BrokerNotes research team. All BrokerNotes content is researched, fact-checked, and edited by the research team.

Content

These ratios are important for assessing how a company generates revenue and profits using business expenses and assets in a given period. Internal and external stakeholders use financial ratios for competitor analysis, market valuation, benchmarking, and performance management. The ratios you will use most frequently are common size ratios from the income statement, the current ratio, the quick https://www.bookstime.com/ ratio and return on assets. Your specific type of business may require you to use some or all of the other ratios as well. The use of financial ratios is a time-tested method of analyzing a business. Wall Street investment firms, bank loan officers and knowledgeable business owners all use financial ratio analysis to learn more about a company’s current financial health as well as its potential.

What are the four classifications of financial ratios?

- Liquidity ratios.

- Activity ratios (also called efficiency ratios)

- Profitability ratios.

- Leverage ratios.

It is the number of times a company’s current assets exceed its current liabilities, which is an indication of the solvency of that business. Financial ratios can be an effective strengths

and weaknesses analysis tool. Their principal use is to assess the

firm’s ability to survive. To survive in the long term, the firm

must be profitable and solvent. Profitability is defined as the

difference between a firm’s revenues and its expenses.

Working Capital Ratio

The best way to use P/E is often as a relative value comparison tool for stocks you’re interested in, or you might want to compare the P/E of one or more stocks to an industry average. They can rate and compare one company against another that you might be considering investing in. The term “ratio” conjures up complex and frustrating high school math problems, but that need not be the case. Ratios can help make you a more informed investor when they’re properly understood and applied. You can learn all the business vocabulary you need with this basic accounting terms infographic. Cash at end of period is $2,200—her starting cash amount, plus the money she earned this month.

Pareto Labs offers engaging on demand courses in business fundamentals. Our library of 200+ lessons will teach you exactly what you need to know to use it at work tomorrow. This is a key indicator of how well a company’s investment in assets (a new factory for example) is helping it generate sales. This ratio should tell you how much money a company has left over to pay interest. It’s often used by banks to determine whether a loan should be approved, because it indicates if a company likely has enough money to pay back its debt, plus interest. What we can see, however, is that the company is financed more with shareholder funds (equity) than it is with debt as the debt-to-asset ratio for both years is under 50% and dropping.

What are 5 key financial ratios?

We’ve briefly highlighted six of the most common and the easiest to calculate. Return-on-equity or ROE is a metric used to analyze investment returns. It’s a measure of how effectively a company uses shareholder equity to generate income.

A small ITO ratio suggests that the firm is

holding excess inventory levels given its level of total revenue. Likewise, a large ITO ratio may signal potential “stock outs” which

could result in lost revenue if the firm is unable to meet the

demand for its products and services. You can earn our Financial Ratios Certificate of Achievement when you join PRO Plus. To help you master this topic and earn your certificate, you will also receive lifetime access to our premium financial ratios materials.

Find a Business Center

But EBITDA is determined by your own day-to-day operations—so your operating profit margin is the ratio you have the greatest control over. Your operating profit margin is similar to your gross profit margin, but taking general expenses into account as well. You can increase this profit margin by raising prices, lowering COGS, or lowering operating expenses and overhead. Compute a current ratio and a quick ratio using your company’s balance sheet data.

In the event that all short-term liabilities suddenly became due, liquidity ratios provide a glimpse as to whether your company would be able to cover those debts. Working capital is a measure of cash flow, and not a real ratio. Lenders use it to evaluate a https://www.bookstime.com/articles/financial-ratios company’s ability to weather hard times. Loan agreements often specify that the borrower must maintain a specified level of working capital. Although it may be somewhat unfamiliar to you, financial ratio analysis is neither sophisticated nor complicated.

Times interest earned (TIE) ratio

Generally, experts recommend you keep your cash flow coverage ratio above 1.0 to attract investors. Do that by taking all your current liabilities at the beginning of an accounting period, all your current liabilities at the end of a period, adding them together and dividing by 2. To use this formula, you need to calculate your current average liability. Your current liability can change month to month as you pay down the principle on a debt; calculating an average takes that into account, so you can get a ballpark figure. That’s Suraya’s total cash flow from operations ($700) minus the cash she spent on equipment ($500).

Financial ratios are good key performance indicators used to measure a company’s performance over time compared to competitors and the industry. Calculating accurate financial ratios and interpreting the ratios help business leaders and investors make the right decisions. Companies use the return on assets ratio to determine how much profits they generate from total assets or resources, including current and noncurrent assets. To find the quick ratio for his company, we’d add his most-liquid assets ($80,000 + $20,000) and divide them by his current liabilities to find his quick ratio of 0.5. Since this is less than 1.0, Matt doesn’t have enough assets he can quickly convert to cash to cover his current liabilities.

How to Calculate Financial Ratios of Performance

This ratio shows how quickly a company can settle current obligations. Another common efficiency ratio and capacity ratio is the equity turnover ratio. Like the working capital turnover ratio, the equity turnover ratio looks at how efficiently a business is using its value — in this case, equity — to drive construction revenue. Liquidity ratios determine a company’s ability to pay off short-term debts using available assets.

What are the three financial ratio classifications?

Financial ratios are grouped into the following categories: Liquidity ratios. Leverage ratios. Efficiency ratios.

On the

other hand, remember that accounts receivable must be financed by

either debt or equity funds. If the RTOT is too high, the firm is

extending a lot of credit to other firms, and the financing cost

may become excessive. Another concern is that the longer a firm

extends credit, the greater is the risk that the firm’s accounts

receivable will ever be repaid. A cash flow margin ratio calculates how well a company can translate sales into actual cash.

In total, she had $200 cash come into her business this month. The Z-Score is at the end of our list neither because it is the least important, nor because it’s at the end of the alphabet. In return for doing a little more arithmetic, however, you get a number—a Z-Score—which most experts regard as a very accurate guide to your company’s financial solvency. In blunt terms, a Z-Score of 1.81 or below means you are headed for bankruptcy. Using balance sheet data for the Doobie Company, we can compute the debt-to-worth ratio for the company. In general, quick ratios between 0.5 and 1 are considered satisfactory—as long as the collection of receivables is not expected to slow.

There may be others that are common to your industry, or that you will want to create for a specific purpose within your company. Difficult problems arise when making comparisons

across firms in an industry. In addition, firms within an “industry” often

differ substantially in their structure and type of business,

making industry comparisons less meaningful.

While the application process varies depending on the specific lender, you can follow these general steps to get a business line of credit. So, if your application was https://bookkeeping-reviews.com/how-to-get-a-business-loan-in-6-simple-steps/ rejected on the first try, you’re not alone. However, you may have better luck if you resubmit your application or simply choose another lender or type of financing.

Before you apply, it’s helpful to understand how lenders are likely to evaluate your business loan application. Lender profits are based upon whether or not borrowers pay back loans. With that in mind, they may consider a number of factors including revenue or cash flow, time in business, personal credit scores, business credit scores, collateral, and industry. It can be difficult to find business loans for startups because lenders prefer a track record of successfully servicing debt as well as running a business. Traditional lenders will often require two years in business, but some online lenders only require a year in business. Idea-stage startups (businesses without revenues) have the most difficult time qualifying for term loans or lines of credit, but a business credit card or crowdfunding could be a good option.

Step 5: Submit Your Application & Provide Documents to the Lender

He presented his vision for Great Outdoors Tulsa, showcasing his extensive knowledge of the outdoor industry and emphasizing the untapped market potential in the area. To get started, tally up anything extra you have that could be used for capital. Boats and extra houses or cars are the obvious things, but anything else that you can call “extra” could be used to help you fund your business. You’ll be living lean for a while, so you must pay special attention to your personal and business finances to come out on top. Since it’s all about reducing the risks, banks will often ask newer businesses that depend on the key founders to take out insurance against the deaths of one or more of the founders. And the fine print can direct the payout on death to go to the bank first, to pay off the loan.

- Turnaround times vary by lender, and it can take as little as five minutes or as long as several days to get a decision.

- Our experts have been helping you master your money for over four decades.

- If your company routinely deals with invoices, you’ve most likely experienced the headache of delayed payments.

- Find the ideal business loan for your qualifications and company’s needs by comparing offers before applying.

- These two factors are perhaps the most important when cash is tight.

You’re most likely to qualify for a low interest business line of credit if your FICO credit score is at least 670. If your credit score is fair or poor (580 or less), it may be harder for you to find a loan with low rates, or get approved at all. There are alternative lenders that may offer business lines of credit no matter your credit score, but be sure you can afford the payments before taking on any debt. First, you’ll need find the right type of loan for your small business based on factors like your business needs, credit score, time in business and revenue. Comparing lenders is also key to finding the lowest interest rate and most favorable terms available to your small business. Applying for online business loans is often quick and automated — you may even receive immediate approval if you meet the requirements.

Decide How Much Funding You Need

You’ll also need to make sure that you meet the lender’s requirements for credit score, time in business and cash flow, ensuring that your business can easily handle loan repayments. Let’s walk through the process for choosing and applying for a business loan step by step. “If you do take on short-term financing of any kind, shop around to find the best rates and fees, pay it down ASAP, and don’t become too dependent on it.” Getting a business loan can be important for running and building your company, whether you’re expanding to a new location, preparing for a busy season, or dealing with an emergency repair. However, requirements, rates, and repayment terms can vary depending on the type of loan. If you want to align financing with your goals, you’ll need to understand and compare your options.

- A business line of credit is a handy way to access financing as needed rather than receiving a lump-sum payment such as with a small business loan.

- Security for the lender may mean lower rates for you, but also the risk of losing an asset.

- We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site.

- You’ll be living lean for a while, so you must pay special attention to your personal and business finances to come out on top.

Depending on the lender, applying for a business loan can take anywhere from a few minutes to several hours. But taking on a potentially significant financial obligation at the outset of a new venture is a major decision, especially for entrepreneurs launching completely untested business ideas. With this line of credit, you only pay interest on the cash you draw from the credit line and any unused credit doesn’t accrue interest. Like a business loan, a business line of credit can be unsecured or secured with collateral. Finder.com is an independent comparison platform and

information service that aims to provide you with information to help you make better decisions.

Find Out How to Get Approved

Finder monitors and updates our site to ensure that what we’re sharing is clear, honest and current. Our information is based on independent research and may differ from what you see from a financial institution or service provider. When comparing offers or services, verify relevant information with the institution or provider’s site. Other factors, like your industry or business structure can affect your ability to qualify for a loan. For example, corporations and LLCs can find financing almost anywhere but partnerships and sole proprietors may have fewer options. Don’t ignore trade credit from your suppliers either, that is one of the most underused types of business credit available to businesses.

While these loans are definitely friendlier to smaller businesses, it can still take up to 90 days for an SBA loan to be processed. Business loans are among the most common forms of financing available to founders looking to start a business or support business needs. But the choice of whether to apply for a business loan is a major decision for every business owner, and not one to be taken lightly. Lenders that offer business lines of credit charge a variety of fees and penalties. Before you finalize an application, compare fees and interest rates to ensure you’re getting the best deal.

A conventional lender can be an option if you have a good credit score and small business finances. In case you don’t meet these requirements, you can look online for less traditional loan options, such as a merchant cash advance. Before we get into what you need to get a business loan, you should probably understand what a business loan really is. But the loan is used to cover a wide array of different business needs, whether that’s equipment, inventory, or just basic working capital. These different needs can sometimes determine the type of loan you’d want to apply for—which we’ll get into below. You can probably use a traditional lender if you have a good credit score and small business finances.

As a small business owner, your personal credit score will often be a part of an evaluation of your creditworthiness. This is especially true for younger businesses or those without significant revenues. That’s because lenders are trying to determine whether you are likely to make payments on time, based upon what you’ve done in the past. Before you apply for small business financing, it’s critical that you understand your credit profile.

Join 446,005 entrepreneurs who already have a head start.

You can typically avoid this fee by choosing standard ACH processing, but you may have to wait an extra one or two business days to receive the funds. A business line of credit is a form of revolving credit that allows you to withdraw money as needed, as opposed to a typical loan that’s paid in a lump sum. A business line of credit can be best for managing cash flow and ongoing expenses, and you can draw on it up to a predetermined limit. Anna Serio is a lead editor at Finder, specializing in consumer and business financing. A trusted lending expert and former certified commercial loan officer, Anna’s written and edited more than 1,000 articles on Finder to help Americans strengthen their financial literacy. Her expertise and analysis on personal, student, business and car loans has been featured in publications like Business Insider, CNBC and Nasdaq, and has appeared on NBC and KADN.

- Our editorial team does not receive direct compensation from our advertisers.

- A typical business line of credit has a draw period that lasts for anywhere from one to five years, and during that time, you can withdraw money from your line of credit.

- Once you reach the limit, you need to continue making repayments and can’t make additional draws.

- After you create a Nav account and connect your business data, you can see if the business credit bureaus have your business on file.

You might have to look online for less conventional loan options, like a merchant cash advance, if you don’t meet those requirements. Online lenders, also called nonbank or alternative lenders, utilize digital underwriting technology to approve or deny business loan applications with record speed. For https://bookkeeping-reviews.com/ example, Fundbox claims to make a funding decision in as little as three minutes. If you can’t gain approval from a traditional bank, you might have a better shot with an alternative lender since they tend to look beyond credit scores. Some lenders can prescreen your application with a few questions.

Stone tablets that outlined transactions between two parties were discovered in the ruins of Babylon. Record-keeping documents were found for estates and farms in ancient Greece and Rome. As time passed, the use of machinery facilitated mass production during the Industrial Revolution, and bookkeeping became an essential need. The growth of industry increased the demand for technology to keep up with fast-paced business transactions.

Overall, this process reduces manual data entry, which translates to less human error and better efficiency. In high demand is RPA, one of the more popular of the latest technologies to help companies automate rule-based tasks in accounting and to eliminate manual entry. According to a report from Tipalti, an accounting software company, 76% of finance executives concur that manual tasks are still a heavy burden to their teams. By doing so, your accounting department or firm can experience enhanced efficiency and seamless integration for automated tax preparation and planning.

Cloud Computing

Big data has become a rich resource that needs to be tapped to compete effectively. But for businesses ready to leverage the potential of digital tools, this shift is an opportunity, not a threat. Far from replacing the accountant, technology is empowering the accountant to rise to loftier heights, which bodes well for the future of the profession. Young prospective accountants are coming into a world set to be transformed by technology, where they will be involved in high-value, high-impact activities driven by innovation.

In today’s finance and business landscape, the importance of technology in accounting cannot be overstated. As the accounting domain adapts to dynamic market demands and evolving regulations, technology emerges as a fundamental pillar for staying ahead. For insurers, all of these regulatory and accounting changes and technological advancements are happening in a volatile market environment characterised by unsettled inflation and interest rates, which can hinder investment appetite for new technology. Accrual accounting means transactions are recorded even if cash hasn’t yet changed hands.

How HighRadius Helps Organizations to Automate their Accounting Process?

A small business with more moving parts such as inventory, receivable and payable accounts, and staff payroll probably should use the double-entry bookkeeping method. If you have a bookkeeper and employees, establish rules and procedures for access and security. Well-maintained financial records help lenders and investors to get a clear picture of your business’s condition—critical information they need when considering whether to provide you with additional funding. Knowing your business’s financial health is essential to survival because most small businesses lack the resources of bigger companies; a few missteps can lead to a cash crunch.

This helps ensure all business transactions are properly categorized and ready for use in creating income statements, cash flow statements, the balance sheet, and any other other financial statements. Whether it’s updating your books or keeping in contact with your tax adviser, maintain your business’s financial records and expenses throughout the year. Without any hiccups or last-minute scrambles, you’ll be able to enter tax season confidently. The double-entry system of bookkeeping is common in accounting software programs like QuickBooks.

Cloud computing is driving collaboration in a remote world

These programs allow small business owners to accurately enter and edit financial information on their own, and make better decisions in a much more efficient manner. The new technology benefits business owners because of its accessibility, convenient storage of financials, and ability (if needed) to be discussed with accountants over the phone. In recent years, technology has become a vital component of the accounting and bookkeeping industry. The days of consistent on-site consulting have morphed into brief off-site meetings, with a plethora of additional software now serving as accompaniment for visibility and accountability of business tasks.

In essence, cloud-based accounting technology makes it easy for accountants to maintain their day-to-day accounting activities while providing real-time access to critical data for proactive client engagement and guidance. With today’s accounting technology in place, accountants can shift their focus from tedious tasks to more value-added work. This creates an opportunity capitalize on knowledge and expertise to build more meaningful relationships with clients and create a more sustainable, year-round business bookkeeping technology model that goes beyond tax season. With accounting technology automation and sophisticated diagnostics, accountants no longer have to manually enter information, detect blank fields, or search for numbers that don’t add up. Accounting technology enables accountants to link returns using a tax ID number, so the same changes don’t have to be made across multiple documents. By comparing a tax return with last year’s documents, accounting technology can catch errors before it’s too late to fix them.